Imagine betting all your money on a blackjack hand.

The thrill of potential gains is enticing, but the risk of losing everything is much worse.

That’s what investing in just a few stocks can be like – a high-stakes gamble where you could lose everything.

You’ve probably seen this happen before. A stock dropping 50% in one day, or 90% in a few months. Or a company going bankrupt, so its stock becomes worthless, i.e. drops 100%.

For example:

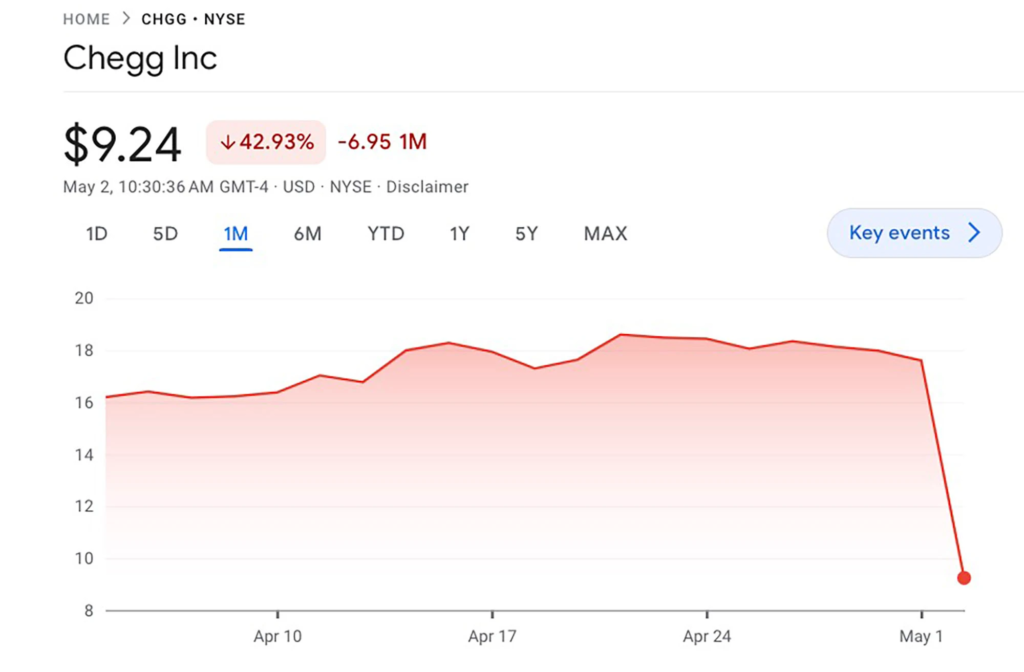

- In May 2023, Chegg, an online tutoring and homework assistance company, had its stock drop 42% in a single day, after it reported that it would not meet revenue estimates, primarily because of the rise of ChatGPT in education which led to reduced demand for its services.

The most devastating kind of loss in investing isn’t temporary, it’s total, permanent, and unrecoverable. This is called a permanent loss. Your investment plunges to zero, you lose all of your initial investment, with no way to recover. This typically happens because a company goes bankrupt.

Once it’s gone, it’s impossible to get back.

When we talk about “losing money” in investments, we are specifically referring to this permanent loss.

It’s expected for investments to sometimes decline significantly in value.

However, permanent loss only occurs if you sell and lock in those losses. Or, the company goes bankrupt, so your investment become worthless.

Warren Buffett, one of the greatest investors of all time, has a simple yet powerful rule for investing:

“The first rule of an investment is don’t lose money. And the second rule of an investment is don’t forget the first rule. And that’s all the rules there are.”

Why is this so important? If you lose money, you need a significantly higher rate of return just to get back to where you started.

For example, if you lose 50% of your investment, then you need a positive 100% return just to break even. This is not just difficult, but also quite stressful.

If a single stock loses 50%, there is no guarantee that it will recover. You may have heard the strategy to “buy the dip”. With individual stocks, this can be risky. A stock can continue declining and declining until it eventually reaches 0.

For example:

- Wish (parent company ContextLogic Inc.), an online e-commerce platform, had its stock decline significantly from 2020 to today (May 2023), because of declining earnings and intense competition in the e-commerce sector.

The good news? In the long term, the stock market (as a whole) almost always recovers.

This means that if you invest in a large number of companies, you can avoid turning a temporary decline into a permanent loss.

This strategy is called diversification, and it’s often called the Holy Grail of Investing.

The idea is: Even if one or two of your stocks drop drastically or go to zero, the performance of the others can help balance out the losses, preventing a permanent loss scenario.